The idea of cash laundering is essential to be understood for those working within the financial sector. It's a course of by which soiled money is transformed into clear cash. The sources of the money in precise are felony and the money is invested in a method that makes it appear like clean money and conceal the id of the felony part of the cash earned.

While executing the financial transactions and establishing relationship with the new customers or sustaining current customers the obligation of adopting adequate measures lie on every one who is part of the organization. The identification of such ingredient to start with is straightforward to deal with as a substitute realizing and encountering such conditions in a while in the transaction stage. The central financial institution in any country supplies full guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide enough safety to the banks to discourage such conditions.

Anti-Money Laundering AML is a course that teaches you about two of the most pressing challenges that financial companies face today. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to appear as legitimate business profits.

Money Laundering Meaning In Thai Both Money Laundering And Confiscation Measures Target The Criminal Proceeds Which Often Money Laundering Is Defined As Transferring Illegally Obtained Money Or Investments Through An The

CAMS is an established global qualification that outlines the key principles of money laundering and how to prevent it.

Money laundering certificate meaning. And passing the CAMS exam will enhance candidates knowledge and expand their expertise needed to protect organizations and prevent crimes. CAMS Certified Anti-Money Laundering Specialist is the global gold standard in AML certifications with more than 40000 CAMS graduates worldwide. Certified Anti Money Laundering Expert is the individual who has completed the uniform examination offered by Indiaforensic.

The term money laundering is any process that conceals the origins of money obtained by illegal means. Money Laundering and Terrorist Financing Regulations Economic Sanctions and Politically Exposed Persons are all topics included in this course. The CAMS certification keeps anti-money laundering specialists aware of new industry trends.

Youll need to sign in to your account to read them. Meaning of Money Laundering. Even more importantly it demonstrates to regulators that the employers are committed to combating money laundering.

Gross Profit Gross profit is the. CAMS Certified Anti-Money laundering Specialist is the most prestigious and coveted certification for AML professionals not only in India but the world. Moreover CAME is one of the global choices for the aspirants looking to enter in compliance profession.

In this course you will learn the definition of this term how people try to disguise their income and the different types of methods they use. In this course you will learn how money laundering works how to identify the warning signs of money laundering and how organisations work to prevent it. Over the course of time the prevention of money laundering has had to change in response to specific events around the world.

Indiaforensic which imparts training and certifications on Anti Money Laundering defines money laundering as any procedure that cleans funds of their criminal origins permitting them to be utilized inside the financial system. A practical introductory-level course that will give you a solid understanding of core money laundering and terrorist financing risks. You may ask yourself what does money laundering really mean.

Suitable for operational or front-line staff as well as those considering embarking on a new career in AML as a stepping-stone for study at a higher level. So Money Laundering is. Money laundering and terrorist financing.

HMRC sends messages to your anti-money laundering supervision account not your business tax account. Anti Money Laundering Certification in India. This certificated is gold standard for someone who aspires to make a career in AML and to stand out in this field.

Hence Certification in Anti-Money Laundering is an aim to meet the rapid growth of the skilled resources in the banking industry. In as little as three months individuals and teams can be certified as Anti-Money Laundering. Once you have successfully completed this course you will gain 30 Entry Level credits towards STEP membership and be awarded the STEP Certificate in Anti-money Laundering.

What Is Anti Money Laundering AML. It is a key operation of the underground economy. The examination questions are drawn from across the syllabus and candidates must achieve 50 in order to pass the Certificate.

This on demand course is awarded in association. Anti-money laundering AML refers to the laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate. CAMS is currently available in.

Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. With this certification financial auditors prove they are committed to the development of their professional skills. We offer self-study and enhanced learning packages to get you qualified in as little as three months.

The CAMS certification is the only certification for anti-money laundering specialists. Money laundering is the process of changing large amounts of money obtained from crimes such as drug trafficking into origination from a legitimate source. It is a crime in many jurisdictions with varying definitions.

The international edition of Certified Anti-Money Laundering program offers an exhaustive content available for the students. Money laundering is a serious offence as it allows people to make money from crime. Money Laundering refers to converting illegally earned money into legitimate money.

In recent years Financial Crime has hit the headlines and the spotlight is firmly on compliance. Certificate is important for the professional development. From a career advancement perspective the CAMS certification means better job opportunities and higher wages.

Data related to money laundering is very sensitive data and it cant be outsourced. It makes money clean by rendering it untraceable.

Pdf Phd Thesis Anti Money Laundering Regulation Viritha Pdf Viritha B Academia Edu

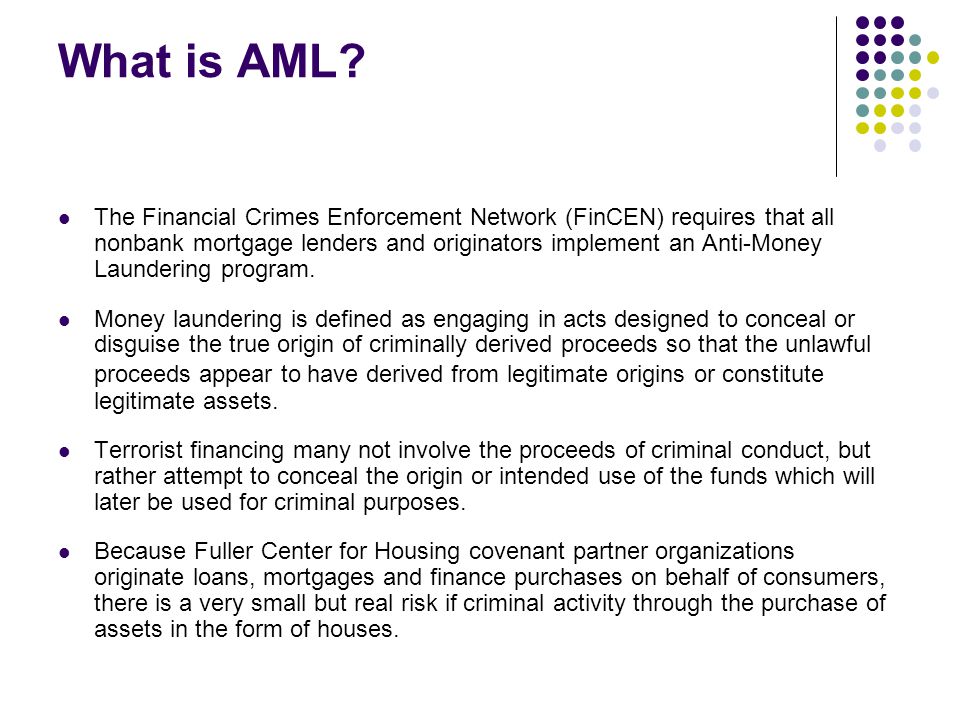

Anti Money Laundering Aml Ppt Video Online Download

Ppt Anti Money Laundering Awareness Training Powerpoint Presentation Id 730997

Key Component Of Aml Anti Money Laundering Compliance Program Plianced Inc

Anti Money Laundering Overview Process And History

Pdf Eu Anti Money Laundering Regime An Assessment Within International And National Scenarios

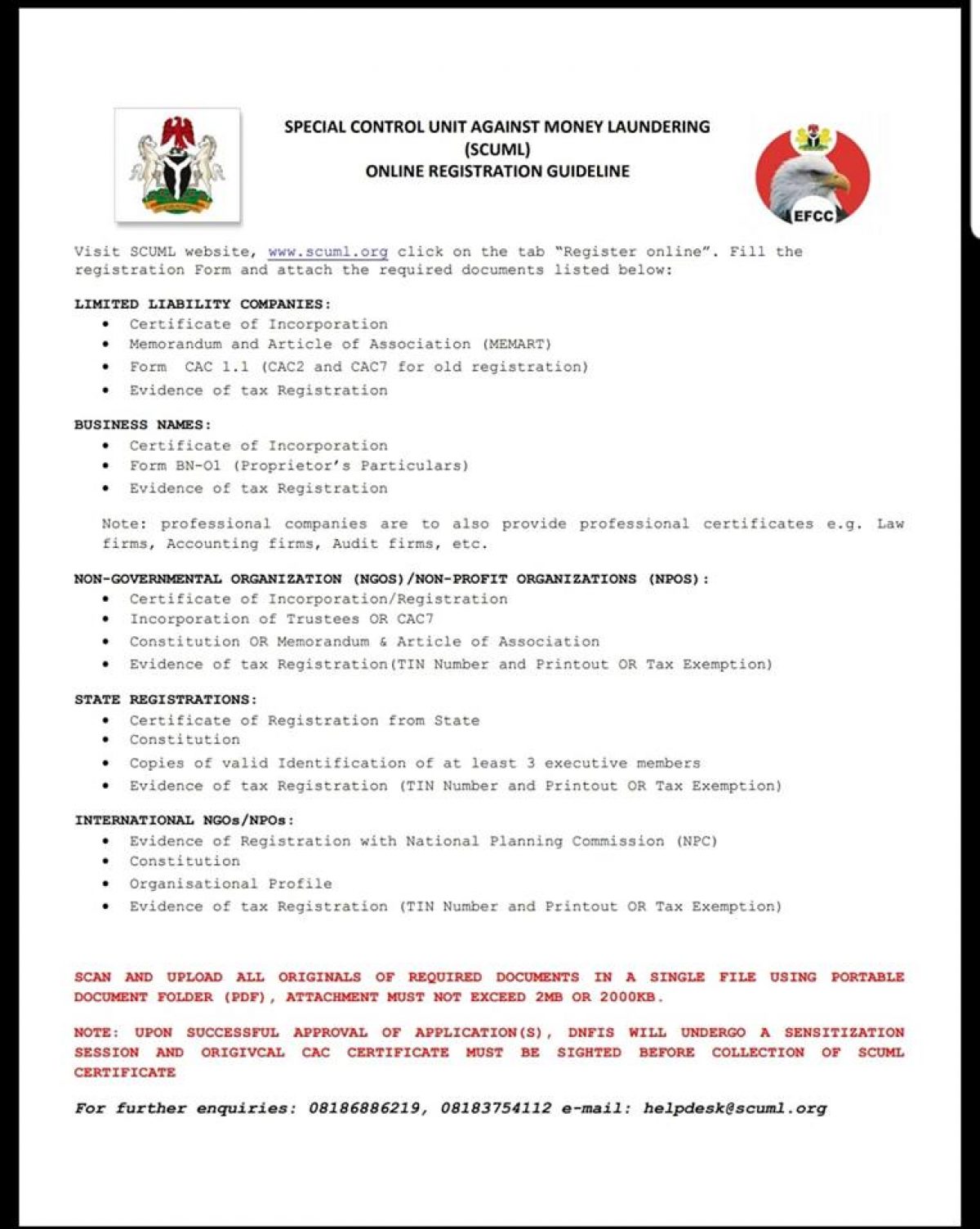

How To Obtain Scuml Registration From Efcc With Ease Business Post Nigeria

Acams Cams Certified Anti Money Laundering Specialists Ppt Download

Pdf Combating Money Laundering And The Financing Of Terrorism A Survey

What Is Money Laundering And How Is It Done

Anti Money Laundering And Counter Terrorism Financing

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Revised Central Bank Amla Guidelines Anti Money Laundering

The world of rules can appear to be a bowl of alphabet soup at instances. US money laundering regulations aren't any exception. We now have compiled a listing of the highest ten cash laundering acronyms and their definitions. TMP Risk is consulting firm focused on protecting monetary companies by lowering threat, fraud and losses. Now we have huge bank expertise in operational and regulatory threat. We have a robust background in program administration, regulatory and operational risk as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many adversarial penalties to the group as a result of dangers it presents. It increases the likelihood of major risks and the opportunity value of the financial institution and ultimately causes the financial institution to face losses.